Our monthly family finance huddle

The title could be a bit misleading: I’ll be talking about how the Osipov household runs our monthly financial check-in. I’m not brave enough to share the details of our family finance on the Internet (but I’m happy to grab a coffee and chat - face-to-face I’m an open book). Because of that, this post is light on detailed screenshots and tables, opting in for generic visuals and overall vibes.

While my wife and I share the same values of frugality, not keeping up with the Joneses, and spending our money where it matters, our approach to personal finance differs. My partner thinks of money in terms of buckets - cash coming in from source X is different than cash coming in from source Y, and must be accounted for differently. It’s all about budgeting, a complicated web of accounts and buckets, as well as many automated transfers. I, on the other hand, have a much more free-for-all approach to personal finance. I don’t spend money if I don’t have to, and to me credit card points are no different than the dollars coming in from a paycheck. We’re both equally frugal, but we get there differently.

On the first of every month (plus minus a day or two - life tends to get in the way), my wife and I go through our financial check-in. It’s something we’ve done consistently for years, and I think in addition to controlling our spending, our monthly reviews have helped us be on the same page.

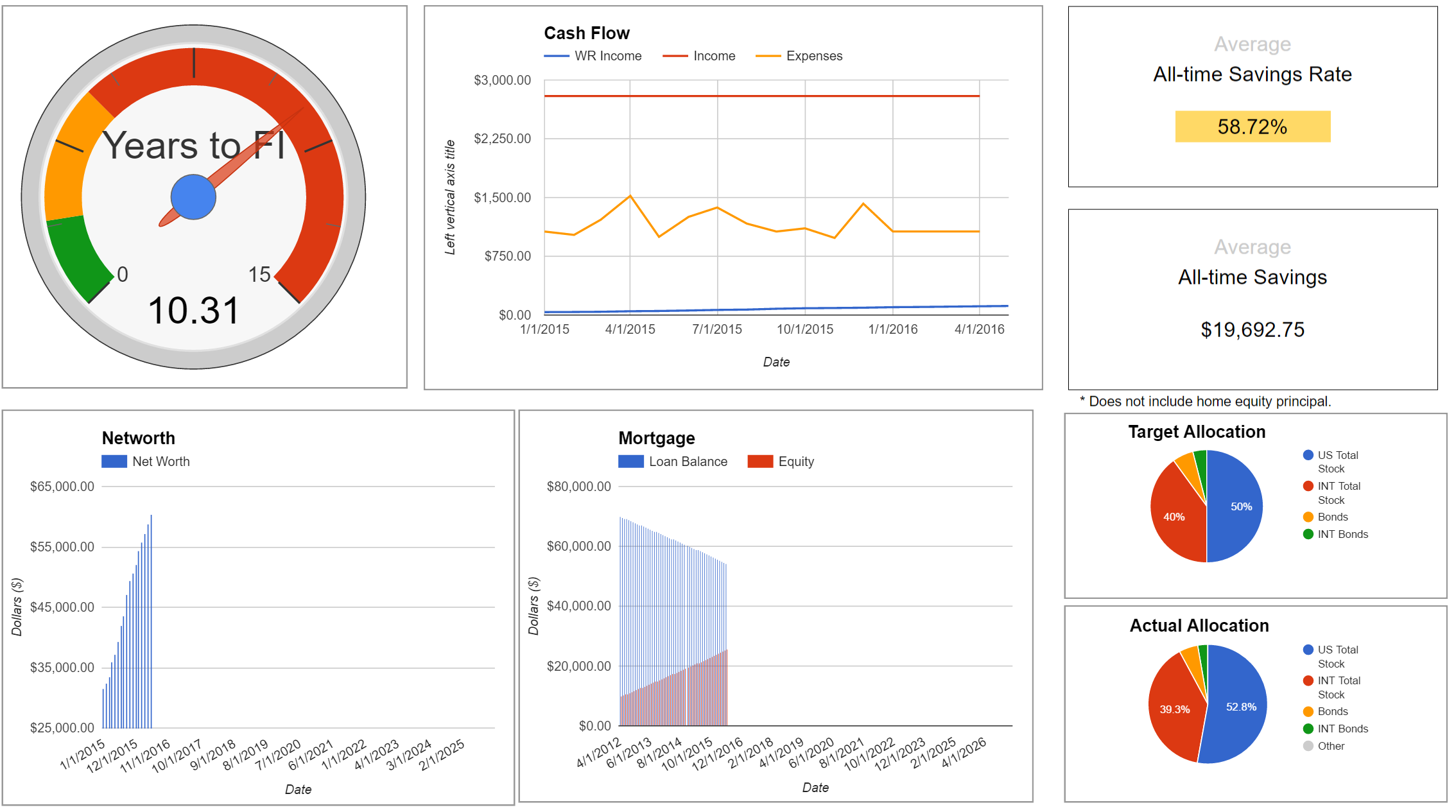

Since 2017 we’ve been keeping our finances in a spreadsheet. Originally built off of the IndyPendent’s one sheet to rule them all, it’s been rewritten many times over. It’s also a great opportunity to refresh the sheet during our check-ins. In fact, I’ve written about how we track portfolio allocation before - that’s one of the sheets within our larger file.

So, what does this monthly ritual involve?

First and foremost, we log the value of all of our accounts as of that day - 401k, investments, credits cards, mortgage - all of it. Having a log going back multiple years really helps. You get to see how your net worth and savings rates correspond with life and world events over time. Because of this rigorous accounting, I’m able to run fun analyses like savings rate plotted over 8 years.

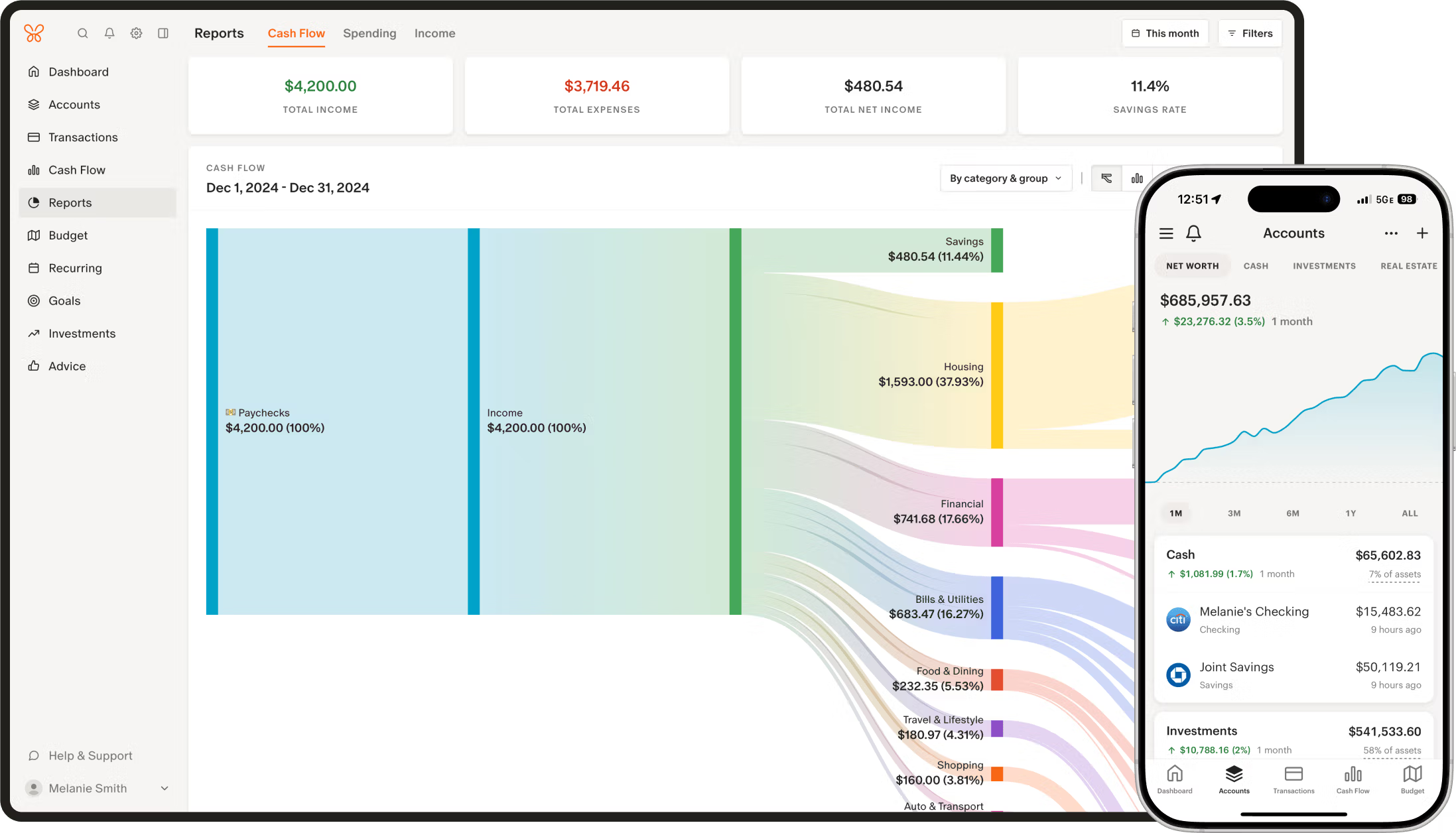

While we keep the original spreadsheet the source of truth, we sometimes try out different personal finance services. We always use the spreadsheet, but sometimes we might use something else alongside it. Monarch is my current favorite: it connects to our institutions, allows you to set rules for transaction categorization, and most importantly natively supports CSV imports and exports for every page. Monarch is worth the money (at least for now), here’s a 50% off the first year.

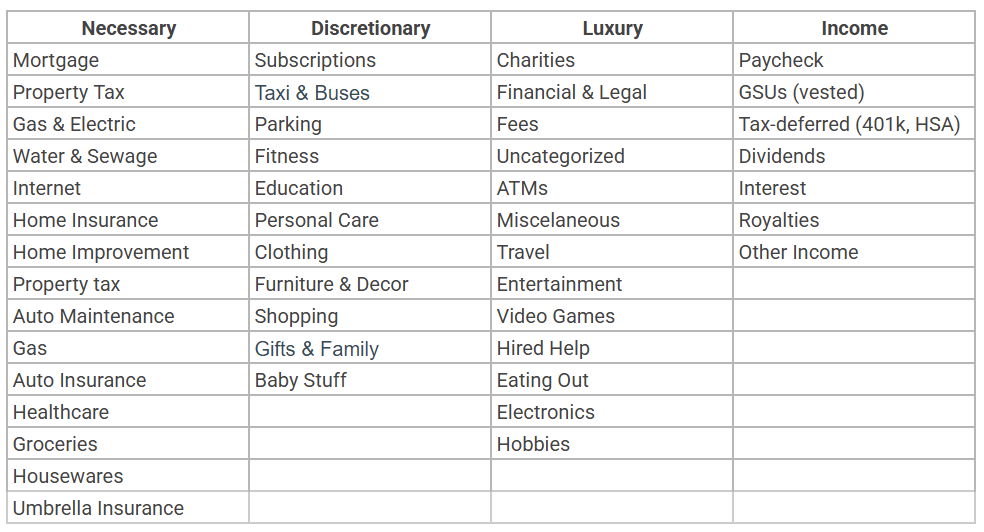

So, back to the first of every month. We use the same transaction categories in our spreadsheets and in Monarch, so we’re able to import the transactions one-to-one. And it’s great to be able to leverage robust Monarch categorization rules! This is where we track where every dollar goes.

Right, so updating spreadsheets and syncing Monarch is just the mechanics. The real meat of our monthly check-in is the conversation that follows. You might imagine that with my wife’s structured bucket system and my more, let’s say, holistic view (although my approach can be better described as “vibes”), these chats could get tense. But honestly, because we do this regularly, it’s usually pretty smooth sailing – more of a collaborative tune-up than a debate.

Here’s a taste of what actually goes down:

- Expenses recap: We eyeball the spending categories. “Okay, looks like dining out crept up a bit last month – maybe we dial that back?” or “Nice, we really kept the grocery bill down.” Sometimes it’s just acknowledging reality, like the inevitable sigh when we see the combined total for Amazon or Trader Joe’s. Seeing the numbers laid out often sparks easy agreements on minor adjustments.

- Looking ahead: This is crucial. “Hey, tax season’s coming up, do we have enough saved up?” or “We talked about that weekend getaway, should we start putting money aside specifically for it?” It prevents big expenses from sneaking up on us and lets us plan. My wife might earmark funds in our budget; I might just mentally note, “Okay, less random spending for a bit.”

- The big picture: How are we tracking towards the big stuff? Retirement contributions, mortgage paydown, saving for [insert next big goal here]? Even if the market’s doing crazy things (cue the “oh God where are the stock markets” comment), we look at our savings rate and long-term progress. It grounds the month-to-month fluctuations.

- Mixed methods: This is where our different approaches intersect. My wife might point out, “The ‘home maintenance’ bucket is looking low, and we know the fence needs fixing.” I might counter with, “Yeah, but overall savings look strong this month, maybe we can cash flow it?” Often, the solution is a blend – maybe we allocate a bit more to that bucket and agree to watch discretionary spending elsewhere. The shared goal (fixing the fence without derailing savings) matters more than how the money is mentally accounted for.

- Actions: The chat isn’t just talk. It often ends with concrete next steps. “Okay, I’ll transfer $X from checking to the investment account,” or “Let’s agree to cap ‘hobby spending’ at $Y next month,” or “You research refinancing options, I’ll look into estimates for that car repair.”

It’s not always a deep, soul-searching conversation with printed out visuals and a presentation to boot (that’s what a year-end review is for, anyway). Sometimes it’s quick: update the numbers, glance at the summaries, confirm things look okay, high-five, done. But having that dedicated time every month means we’re consistently aligned. It prevents financial decisions from becoming unilateral or sources of friction, instead turning them into regular, shared checkpoints, even with our different money brains.

Typically this would be the part where I share the spreadsheet template with you (or even pretty screenshots), but the spreadsheet is currently way too customized for our individual needs, and untangling it for more general use would be quite an undertaking. But let me know if there are any aspects that interest you and I can pull out the logic similar to what I did with our portfolio allocation tracker.