Three reasons to avoid market speculation

Hi, you’re likely a casual retail investor, and I probably sent you this link as we were chatting about investing. The topic comes up often, and I think I summarized my points rather well in this article.

I’m a vocal opponent of retail investors trying to time the market and invest in individual stocks. Here are three key reasons why I think you shouldn’t:

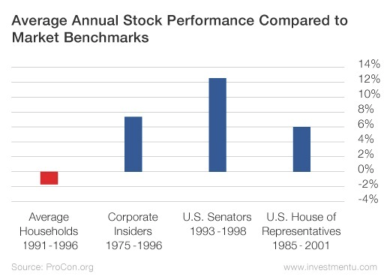

1. You don’t have access to the right information.

Unless you have insider knowledge (hello, esteemed congressmen), you’re not going to have information that institutional investors don’t already have. You don’t have the time, resources, expertise, and, more importantly, connections that financial institutions do.

Further, you probably have access to the wrong information - taking the news cycle and noise like public discourse into consideration.

2. You’re betting on growth.

Stocks are inherently speculative assets. You purchase a share in a company with the hope that the company will become more valuable than it is today. Even if the business is profitable, you’re making a bet that it’ll be even more profitable than it is today. Infinite expansion isn’t guaranteed, and a business can be profitable without growth.

Here’s Verizon, a telecom giant which, in a typical year, rakes in 80 billion USD in gross profit, but whose stock has been stagnant since the 2000s.

3. You’re speculating on top of speculation.

You’re not the only one trading on the stock market. And expectations of future growth are already baked into the share price: if you think Google stock is going to rapidly grow and expand, you’re more willing to pay more for the stock than Google is currently worth. By investing in a publicly traded company as a retail investor, you’re making a bet that it’ll grow more than what other (likely institutional) investors believe it will grow.

In a 2012 experiment, a cat outperformed three teams of institutional investors. The adorable findings are consistent with studies which indicate that investors routinely underperform compared to market indices.

Invest in low-cost index funds. If you don’t know much about the world of investing, consider opening an account with a respectable brokerage firm like Vanguard and invest in an appropriate target retirement date fund. That sounds boring but will reduce risk while exposing you to overall stock market growth. You can (and probably should, eventually) rebalance your portfolio as you learn more about market performance, your financial priorities, and your own risk tolerance.

Thanks for dedicating the time to read through this.