What's in our investment policy statement

“Why did we decide to put our money in that fund?” After a decade of investing, my wife and I found ourselves asking that very question more than once. To combat this kind of financial amnesia, we’ve collected tools along the way - spreadsheets, check-ins, reviews, and of course, the investment policy statement - the definitive answer to “why” and the blueprint for all our future decisions.

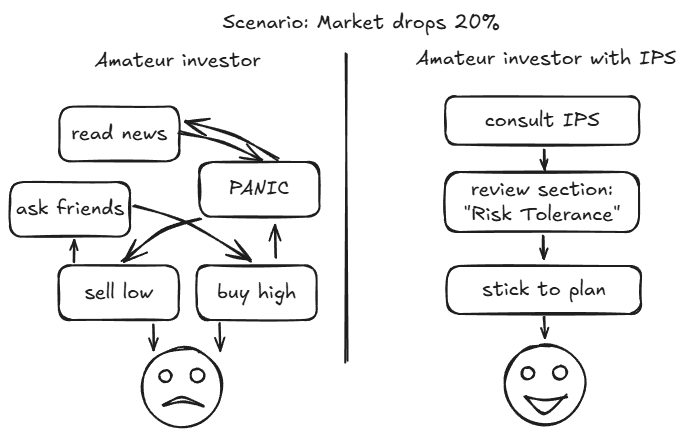

I’ve learned about investment policy statement (often referred to as IPS) through Bogleheads. It provides a foundation for future financial decisions, outlines your investment goals, and keeps you focused on short-term market swings. Here’s a flow chart: I’m not sure why it’s aimed at four year olds and I don’t mean to insult your intelligence with it, I just really wanted to draw a cheeky visual for this post.

An apt reader would probably notice that we’ve had nothing but the bull market exposure, so take all of this with a grain of salt. We’re amateur investors, but I think it’s even more critical to have an IPS as an amateur: it’s easy to react to market fluctuations, and it’s easy to forget about your core financial principles - especially, if like us, you follow the set-it-and-forget it approach. Ultimately I’ve written our IPS because I’m a forgetful man, and I’m tired of having to dig and understand why I’ve made certain financial choices years ago.

Our IPS is about 4 pages long (in 10 pt font and tiny margins), and sharing it here, even with details edited out, is more likely to confuse and overwhelm than to help. Instead, here are the key sections of our IPS, and what’s covered in each section:

- Investment objectives. A short list of bullet points - concrete objectives, including early retirement and target investment income. These are the end goals.

- Core principles. Financial foundations - preference for automation and set-it-and-forget-it investments, our desire to never time the market, and our debt management philosophy. We touch on some family goals, like making sure our children will not lack, or focus on family experiences. These should inform other sections.

- Risk tolerance. Our perspectives on recessions, geographic arbitrage, and supplemental income. This section’s a blueprint to read during scary times.

- Target allocation. A meaty section walking through our stock/bond portfolio split (and the rationale behind), domestic/international allocation, as well as what funds we hold in which accounts and why. This section rationalizes many of the decisions we make using our allocation spreadsheet. This ensures diversification over time and aligns the portfolio with our objectives and principles.

- Investment selection criteria. We manage our own investments, but have occasionally reached out to professionals for a second opinion. We prioritize simplicity and consistency, don’t try to time the market - this mostly echoes the core principles which is a good thing. This bit helps you avoid impulse buys or chasing trends.

- Philosophies: RSUs, 529, and real estate. How we think about restricted stock units (one of the ways we get paid), 529 (an education fund for the kiddos), and real estate (we don’t much care for being landlords, but want to own our own home).

- Rebalancing and benchmarks. How do we know when to rebalance (something we do annually), what do we benchmark against and what our return expectations are. In other words, how to maintain desired risk level and measure progress towards our goals.

- Giving strategy. How we think about supporting extended family and non-profit organizations.

We store our investment policy statement with our estate planning documents - while not legally binding, it can serve as a north star to our successors. Our estate attorney has a copy in their archive as well.

If you don’t have one, I highly recommend creating one. It doesn’t need to be four pages. Your first step: open a blank document and write down one sentence under the heading “Our Goal”. For example: “We want to be financially independent by age 55”. Congrats, you’ve just started your investment policy statement. Continue from there - it can be as short or as long as you want it to be, but I know my wife and I have gotten a lot of value out of authoring and discussing ours. You can use our format as a guide, or pick our from great examples available on the Bogleheads wiki.

Shoot me an email if you’re curious about any specific aspects of the IPS or our financial strategy: I probably won’t share the numbers, but I’ll be happy to elaborate on any aspects of our philosophy.