-

Brainstorming terrible ideas in a group

Years ago a colleague of mine taught me a brainstorming technique that I find particularly useful. Thanks, Meagan.

Here’s the thing. Often, when brainstorming in a group, even with a good degree of psychological safety, participants are often worried about appearing like idiots, or having bad ideas. There’s a reputation to maintain after all, and we’re all taught to think before we speak. I find this group brainstorming method to be useful to get around this mental block.

You create four buckets for solutions to a problem:

- Ideal: If I had a long time horizon to solve this problem

- Realistic: If I had limited time and resources

- Wasteful: If I didn’t care about time and resources at all

- Harmful: If I wanted to sabotage the problem

And participants are tasked with populating each bucket. Here’s the fun part: actively harmful and wasteful solutions often lead to the best outcomes.

Let’s walk through the example. Say you have a team wiki that’s neglected and out-of-date. You’re trying to figure out how to solve this problem. Here are the ideas:

- Ideal: Hire technical writers to constantly audit and rewrite the documentation.

- Realistic: Implement a mandatory wiki cleanup day, where each team member is assigned a portion of the wiki to update.

- Wasteful: Award $500 to whoever contributed the most pages to the wiki each year.

- Harmful: Set content to self-destruct after 3 months. If the content is important, someone will write it again.

All of these ideas have problems. Technical writers will not have the context and could put undue communication burden on the team, company mandates are never fun, encouraging quantity of contribution can lead to decrease in quality, and deleting the data defeats the purpose of having a wiki in the first place.

But this gets you thinking - maybe the harmful idea isn’t so harmful after all. Maybe a staleness banner on pages, with a name of the last editor and a nudge to them could help keep the wiki up-to-date.

In my experience, “Wasteful” and “Harmful” buckets have a disproportionate number of responses, many of which start as jokes (“fire everyone”, “reboot every 5 minutes”, “use carrier pigeons”), and improve upon iterations into the winning ideas.

-

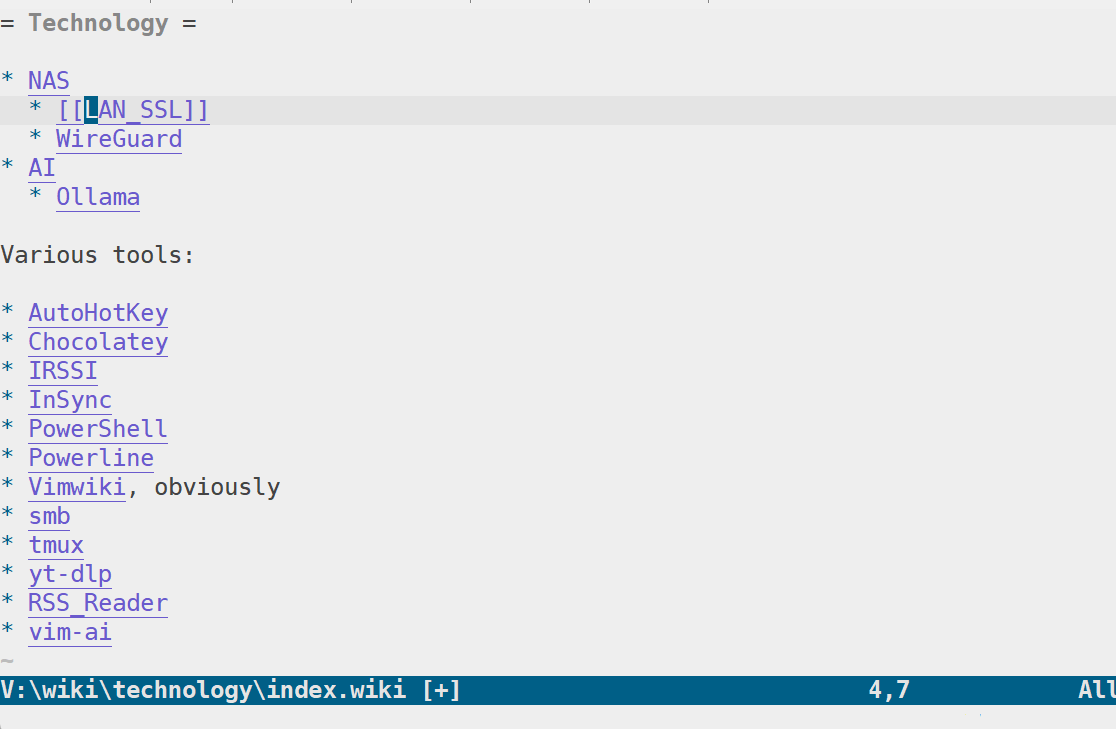

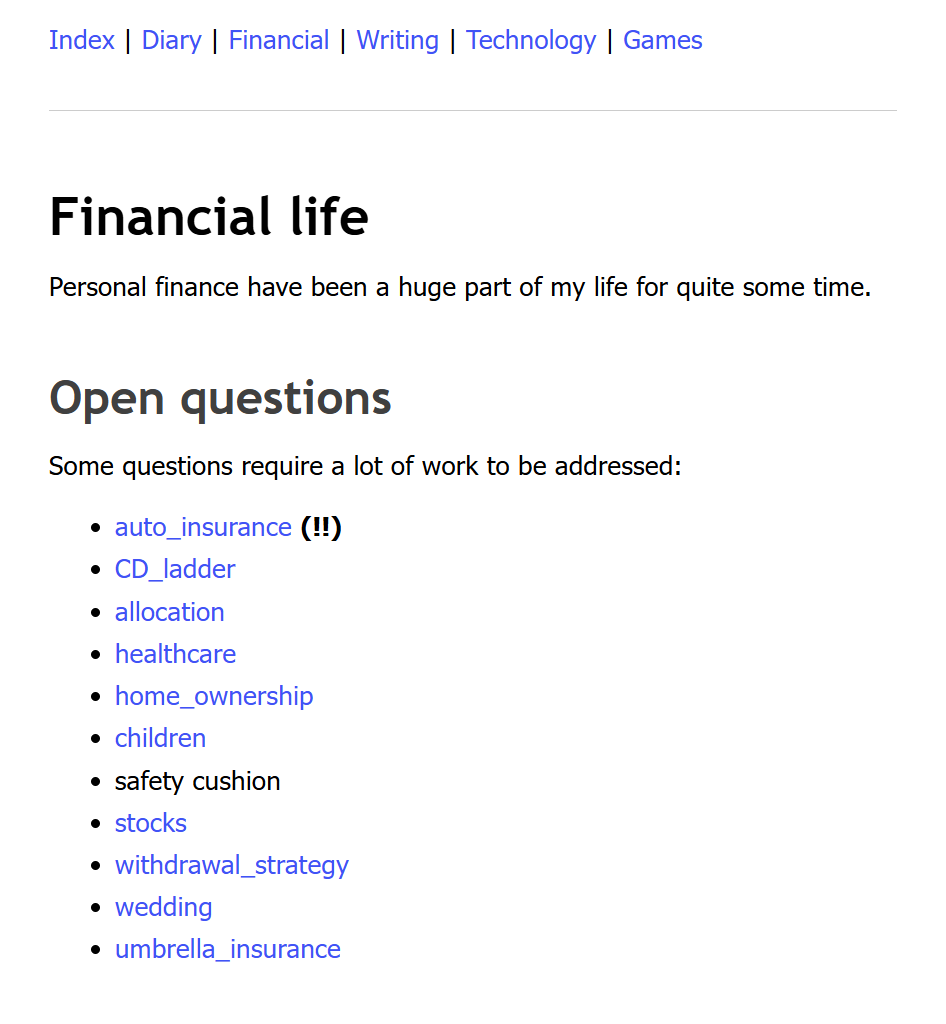

Vimwiki: 11 years later

Vimwiki is a personal wiki plugin for Vim. Using Vim has been a second nature for me for well over a decade (buy my book), and keeping my notes organized using Vim continues to be the best approach. It’s been 11 years of using Vimwiki, here are some reflections.

If you’re instead looking for a tutorial on how to set up and use Vimwiki in Vim, my tutorial from 2014 is up-to-date.

So, what do I use Vimwiki for?

A little bit of everything. Occasional journaling, when I don’t want to pull out a journal and a pen. Notes about technology and any projects I might be working on. Reflections on video games I’ve played. Ideas I find interesting. Topic research notes, like when I try to understand a messy and complex personal finance or tax subjects. Writing drafts (my notes on writing cadence could be of interest here).

Hands down the best thing about Vimwiki for me, is that it’s something I’ve kept up for 11 years now, and it’s fully open source and doesn’t rely on external services. I’ve changed storage from Dropbox to Google Drive to hosting the wiki myself, and I’m glad that I get to use the same technology.

Having uninterrupted access to knowledge I deemed noteworthy is useful. It helps me keep my head organized, if only to know that all the thoughts swooshing in my head are neatly organized somewhere on paper. On digital paper, you know what I mean. It’s freeing.

It’s also lovely that under the hood this is just a set of plain text files. I can always manipulate these files using thousands of text manipulation programs, or write my own utility with ease. I’ve leveraged that in rare cases when Vimwiki capabilities were insufficient.

But there are a few notable downsides, too. With the benefits of hindsight and some wisdom over the years.

First and foremost, portability. Vim never graduated into the mobile first world. Yeah, I used to eye roll at Google’s mobile first push of mid-2010s, but the truth of the matter is - I often find myself taking notes on my phone, and then moving those notes to Vimwiki when I have the time (or forgetting those notes exist altogether).

Even on supported platforms - Windows, Mac, Linux, ChromeOS - there’s always some fiddling involved in the setup. It’s not a set-it-and-forget-it solution. There’s always tinkering involved, and there’s a reason my blog has a number of entries titled “how to to use Vimwiki on System X” over the past decade (like how I use Vimwiki for instance). It’s a tinkerer’s choice.

Unfortunately, I can’t think of a significantly simpler solution (outside of plain-text system of notes) that doesn’t lock me into an ecosystem or puts me at a mercy of a company which will shut down the servers once they go out of business.

I’ve looked at simple solutions like TiddlyWiki more than once before, but I keep coming back to using Vim as a primary interface for engaging with all the information I’ve collected over the years.

I solved some aspects of portability through serving my instance of Vimwiki via web. Yeah, Vimwiki can render your files to glorious interlinked HTML (which works out of the box by invoking

:VimwikiAll2HTML). It’s read-only, however, and requires you to figure out how to host your own web server. Which isn’t hard if you already host other things on your local network (which I do), but can be a pain in the butt if you don’t. And you’d be setting yourself up for a security mess on your hands if you’re standing up a web server in the cloud without knowing what you’re doing.For its entries, Vimwiki supports either its own VimWiki syntax (which is based on MediaWiki) or Markdown syntax. I use the VimWiki syntax, and while it makes it harder to migrate away from Vimwiki, I think it’s a better fit for the Vim editing. I’m glad I stuck with the VimWiki syntax, since I find

[[link]]to be easier to parse than[link](link.markdown).Can I see myself moving to a different solution in the future? Possibly. If a fully open source, Vim-friendly, truly portable solution presents itself - sure, I’ll put together some scripts to migrate (or more likely, use AI to help me write one - AIs seem to be good at writing low-risk one-off migration scripts). Do I regret using Vimwiki? Absolutely not, it’s been an amazing companion to me over a decade, and given that the data’s stored in plain text - I’m not worried about losing my data if I ever change my mind.

-

Retro gaming, minimalism, and digital snacking

I’ve often talked about minimalism - I even wrote about it over a decade ago on this very blog. Life ebbs and flows, and I go through phases of accumulating and getting rid of stuff, but nothing compares to the freeing feeling of knowing you only have meaningful things.

My interest in digital minimalism started after I read Cal Newport’s book on the subject. Having a decluttered digital space and focusing on meaningful on-device experiences has been a major focus of mine. I curate my RSS feeds and follow blogs I care about. I only watch YouTube videos from creators I subscribe to.

But something’s been missing. I still wanted a quick, on-the-go experience for when I have five or maybe fifteen minutes to spare. Yeah, the right thing would be to just put down my device and think, clear my head, or maybe even meditate. But my mind, like so many others, just gravitates toward short-form content - Reddit, YouTube Shorts, you name it.

I think I’ve found a solution: the Anberic RG 35XX Pro. Yes, it has a terrible name, but it’s a retro handheld console that can play games from various arcades and consoles, up to and including the original PlayStation 1. We’re talking Game Boy Advance, SNES, Sega Dreamcast, Nintendo 64 - and dozens of others. It even supports PC ports, as long as the graphical requirements are low.

Look, I have a Steam Deck. It’s an amazing device for gaming on the go, but it’s a relatively large device to lug around. Another console I have, the Nintendo Switch, is smaller, but still a little too bulky to fit in a pocket (unless you wear cargo pants, maybe). The Anberic RG 35XX Pro (really, what a mouthful of a name) slides right in my pocket. I can hold my sleeping infant in one hand and play through a classic from my childhood with the other.

And the best part? All of that for a relatively low investment of around $70.

The handheld has a 3.5-inch screen with a 640x480 resolution - which is exactly the resolution many games from that era were built for. Text is large and legible, and decades-old graphics look great on a tiny screen. The handheld also comes with modern conveniences, most notably save states. You can save the game at any point, which really helps with the pick-up-and-play nature of the device.

Outside of PC games, I mostly grew up with PlayStation 1 titles, so I’ve been playing Tekken 3, Final Fantasy VII, and Harvest Moon: Back to Nature. This little console has been a welcome antidote to the endless scroll.

I picked mine up from Amazon: Anberic RG 35XX Pro (affiliate link), or you can order directly from the manufacturer (the price is the same as Amazon once you factor in the shipping).

-

Dad guide to buying baby stuff

Hi there. This is an email-to-a-friend turned into a blog post for posterity. I added affiliate links to Amazon (an occasional click pays for website expenses), but in most cases you can find all of this baby stuff for much cheaper at a second-hand store. Except for diapers, of course.

A few of my friends are in the child planning phase or are going through their first pregnancy. It’s an exciting and scary time, and there are so many things to buy - some are worth it, some aren’t. And as a dad whose daughter passed a six month milestone a few months back - here’s what worked for me and what didn’t, what I thought was worth spending the money on and what was a bit of a scam. Each baby’s an individual though, so your mileage may and will vary.

The vibe

In the first 6 months, I think babies are as expensive as you let them, given that they’re healthy of course. After footing the hospital bills, and a few upfront purchases, the only consistent expenses were diapers, wet wipes, and occasional “oh, I should get this” purchases. While I’m generally not a fan of Amazon’s business model, having same day/next day delivery was a lifesaver, especially in the earlier months.

That being said, we weren’t particularly self-restrictive - but it felt like the first 6 months didn’t really break the bank.

Clothes

So the baby needs clothes to wear, and within the first six months it’s mostly lots of onesies. Here’s the challenge - babies grow fast, and at inconsistent speeds. Baby clothes are sized by age, but the older they get, the less sizes line up with their age. Your six month old could be wearing a 9-12 month outfit, or even a 0-3 month one if they’re tiny.

Because of that, buying lots of clothes in advance is a bit of a waste of money. And having too many outfits for each “size” is also not a great idea, since babies grow in bursts, and sometimes they can just choose to grow an inch in a few weeks and skip a size.

Naturally this makes second-hand clothes a very appealing option. If you can get hand-me-downs - just take them all, it really helps. Pass them on to the next child when done. We lucked out with neighbors having a kiddo two years older than ours, and we got boxes and boxes of clothes. Ask around at work and in your third places - baby clothes don’t really have resale value and just take up space in a closet, most folks are happy to donate.

If you don’t have a community to draw from - that’s not a huge deal either, because baby second-hand clothes are cheap. I mean, really cheap. San Diego isn’t known for its low prices, but a single outfit costs between $1 and $5. Yeah, fancier outfits can be more expensive and we’d splurge all of $10 for a nice dress to take our daughter to a formal event like a wedding.

New baby clothes are overpriced for what they are - an outfit a baby will wear anywhere between 2 and 20 times, and you’d be shelling out $30 on average.

Also, most people in your life will give you baby outfits. You’ll have more outfits than you need, and you might even have to cycle through multiple outfits a day for a photoshoot because the gift outfits are getting really tight and might not fit tomorrow. I’m sure this will change as she gets older, but between hand-me-downs and second-hand stores we probably haven’t spent more than $50.

You need onesies, a couple of swaddles, maybe some sleep sacks as the kiddo gets older. Ours didn’t care for swaddles or sleep sacks after the two month mark, but some babies sleep in sacks for years.

You also need a bunch of large muslin cloths (in addition to a few sheets you will inevitably steal from the hospital), which are a lifesaver for cleaning up, swaddling, and temperature regulation, some burp cloths for a quick cleanup, and a few bibs for when the baby begins to try solid foods (which is right around the 6 month mark).

Bassinet

Okay, there’s lots of crazy expensive and nice bassinets out there. I mean there’s SNOO you can buy for $1,700, which is smart enough to soothe your baby to sleep and probably get you a cup of coffee ready in the morning. We ended up with a cheap ($100) bassinet from Amazon, and glad we didn’t splurge.

Our little one really didn’t like sleeping by herself, and eventually she just moved to our bed. Nights got better, and the bassinet didn’t get much use. Maybe an ultra-smart bassinet could’ve soothed my baby to sleep, but we won’t find that out now.

Bassinets are nice in theory because you can have them right by the bed, which we did - and it would’ve been nice, if our baby didn’t want to be held all the time. Having us nearby wasn’t enough. Some folks skip the bassinet and go straight for the crib, which is an option with more longevity to it.

Stroller and carriers

Just like with the bassinets, there are lots of really expensive strollers out there. We went with a Chicco Bravo 3-in-1 travel system, and it’s perfectly functional. You get a car seat, you get a stroller, and you can also have a car seat clipped into the stroller.

We bought this new, mostly due to safety and recall concerns around used car seats. I think some second-hand shops actually certify their resold seats, but we just went with a new one.

Chicco Bravo handles a bit worse than more expensive brands like Nuna (especially if you have bad sidewalks), but it didn’t feel like a major enough difference to justify paying double or triple the price.

There’s also the carriers, and personally I prefer to carry my baby in a carrier over a stroller, while my wife’s the opposite. There’s the single long piece of cloth you can wrap around yourself or firm carriers like Baby Bjorn, and many options in between. We have a bunch, some bought and some handed down, and both my wife and I and our daughter as she grows have different preferences for which carrier works best. It’s nice to have a mix.

Diapers, wet wipes, and such

You don’t want to cheap out on diapers. Cheap diapers will cause blowouts, and it’s as bad as it sounds. Good diapers hold the poo in very well - we found Pampers to be good enough.

I tried out 5-6 different brands, and some of them fit better than others - babies have different body shapes, so it might be worth shopping around mid range diapers.

Cloth diapers are a thing, and while before having a baby I thought I’d be all cool and Earth conscious, realizing how much babies pee and poo and how hard is that stuff to clean made me reconsider that position. We could barely do our own laundry, traditional diapers are good, apparently.

You also need wet wipes to clean the kiddo’s booty. I tried a whole bunch, and nothing beats the water wipes, even though they’re more expensive. They clean better than most and don’t have any scent, which I think is nice.

You should also get an inexpensive diaper pail - those things are lifesavers, believe it or not - baby poo smells.

Gadgets

Babycams are real nice for watching your baby when they sleep, or doing some chores throughout the house when they play by themselves. Infant Optics has been the workhorse of our household: no WiFi, no Internet connection, just a reliable camera with a screen you can take with you. Works 100% of the time, no fiddling required.

Toys

Lots of toys are given as gifts, and pass-me-downs from friends, colleagues, or neighbors are great here too. Your kid will have preferences for specific toys, these preferences will change over time. You don’t really need that many, and it takes kids a while to start playing with things anyway. Just go with the flow here, don’t overplan.

A few baby books, something to make noise, something with light and movement. Once the little one starts teething (anywhere between 3 to 9 months I think), lots and lots of different teethers. There are no wrong options here.

A small play gym can go a long way too, our daughter used it a lot and still does.

Bath

We bought a little baby bathtub, but most of the time we just bring our kiddo with us in the shower. It’s faster and easier.

You need some baby-friendly soap, shampoo and something to scrub the baby with. But it’s not urgent, you don’t really clean newborns that often - their skin is too sensitive for that. If the baby has a cradle cap, some coconut oil and a scrubber do wonders, but it does take weeks to get off the nasty skin flakes.

Boogers, nails, and gunk

Something I wouldn’t have known about, here are the three things that are must buy:

- Nail sander, because cutting baby nails is impossible. You gotta sand them down.

- Gunk picker, because there’s always random gunk in the nose, ears, and other hard to reach places.

- Booger sucker, because the child will eventually get sick and boogers need to be removed.

And you get them used to these three tools immediately, especially the booger sucker, so that they don’t fight it when they’re sick. Play with these sometimes.

Feeding

Eh, this really depends on breastfeeding vs bottle feeding. If you’re on formula, the hospital will send you home with a small supply of formula (or a very large supply if you’re nice to the nurses).

Bottles are a complicated topic too, babies like different bottle shapes during different cycles of the moon. I would just get a couple of different ones, they don’t have to be fancy in case the baby rejects them. You don’t really need to be overprepared in advance here, collect bottles as you go.

Oh, and we got this bottle washer from a friend, and I think it was useless. You can wash and sanitize bottles in the dishwasher, with all the other dishes. It’s fine.

Feeding’s a really complicated topic, and is even more unique to the baby than the rest of the topics here. Good luck.

Oh - you do probably want a nursing pillow or something like that. It’s helpful for positioning the baby for lots of activities, from eating a boob to play time.

Fitness

Okay, so far I’ve generally been advocating for utmost frugality, but here’s something that I think is worth splurging for: baby-friendly gym membership. There are “mommy and me” classes all around, which my wife took extensively while on maternity leave - it’s a great place to stay in shape, build community, and just take a bit of a breather: it’s one public place where you don’t feel bad if your child’s having a meltdown for whatever reason.

Totally worth it.

I’m about to take a second part of my paternity leave, and I’m looking into “daddy and me” classes - I think these are a great use of money if one of the parents isn’t working. Helps with sanity.

Naturally, all of this is my personal take. My little one might love her cheap high chair now, but yours might only eat from a gold spoon. But I also think there’s a whole industry out there designed to make you feel like you’re doing something wrong if you’re not shelling out for the most expensive thing for your child - and it’s been a constant battle for my family to figure out where we stand.

-

Suprisingly supportive community of WoW Hardcore

We’ll be nerding out about World of Warcraft and MMORPGs today, but no background knowledge is needed.

I don’t play too many online games, but ocasionally I boot up a few leading titles to see what all the fuss is about. This weekend I had some spare time and I picked up World of Warcraft Classic, a rerelease of a popular 20-year-old MMORPG. If you don’t know what WoW is, you’re probably reading this on a printout (thank you?)

World of Warcraft Classic is a different beast. You see, over the past 20 years, the game has changed with modern gaming sensibilities. Progression is faster, gear is plentiful, and grouping up is optional. In vanilla World of Warcraft it was dangerous to deal with more than one enemy at a time, and dealing with groups of mobs or elite enemies required grouping up. World of Warcraft Classic brought that back.

But it created a bit of a problem - with high difficulty and high interdependence with other players came competitiveness, and with it toxicity. WoW can and does get toxic - players often forget about empathy and don’t accept anything other than a perfect play. I mean that’s where all the popular media about WoW nerds treating the game as a job came from.

Which brings me to World of Warcraft Classic - Hardcore. I was curious to find the right experience for a casual player like myself - I looked into dad guilds (yup, those are a thing), but I kept being pointed towards Hardcore realms. Here’s the deal: hardcore WoW realms have a unique ruleset - you only get one life. If the character dies, you start from scratch. And in a grindy and slow MMORPG, that’s some high stakes.

So, how did hardcore realms end up providing a good experience for a casual player? Well, on most World of Warcraft servers, getting to the max character level is a one-and-done deal, making server population skew heavily towards high level players. This means that leveling zones are generally empty, and players who do level characters try to get through the content as fast as possible. This creates limited space for cooperation, because you need to find the right person at the right time and the right place, and heaven forbid you don’t pick the most optimal route or slow down to smell the digital roses.

Hardcore servers offer a very real risk of losing progress, which does happen often enough. Which evens out player distribution, since more people spend the time leveling their characters. And because your character only has one life, more experienced players might have a few characters going through the leveling process, as a backup.

This also slows down the game - all of a sudden it’s not about the fastest way to the highest level, but about a trade-off between safety and speed. Enough of a trade-off to push back the end goals far enough into the future and make players appreciate actually playing through much of the game’s content. Players stop by to chat, role-playing guilds are frequent.

There’s an atmosphere of camaraderie on the server. Every time anyone makes it to level 60 - a max level - a chime goes off and their name’s highlighted in a public chat. Casual guilds are plentiful, and happily share resources with the newbies. A mere set of bags can make a huge difference at early levels.

There’s the instant cooperation too. Getting attacked by more than one enemy in World of Warcraft Classic can be dangerous, and some quests take you right into the middle of enemy camps - or even worse - caves. It’s dangerous to go alone, and it’s common to quickly group up with fellow players to navigate a dangerous encounter. I’ve had lots of fleeting, positive encounters, with players sharing loot and resource nodes freely.

Everyone’s in the same boat, enjoying the perilous journey together. In a handful of hours I put into the game I slowly made my way to level 10 as a dwarf hunter, finally obtaining my pet bear - which my newbie friendly guild celebrated with lots of cheers.

Will I make it to level 60? Definitely not, that journey’s too long and dangerous for a casual player like me. Will I start from scratch if my character dies? I’m not sure. But I know I’m having a great time in a welcoming community, which goes straight into my “good gaming memories” box.