-

AI and the new junior engineer

Being somewhat of an AI sceptic, but having to deal with the advent of AI tooling and its impact on engineering productivity is weird. As is often the case, the other day I was engaging in some AI fear mongering when chatting with my colleague Kate. We got into it, especially the concerns about the future of junior software engineer roles. She made a valid point that many other industries have already navigated significant shifts due to automation (Kate - you legend).

I thought about this before, but I’ve always dismissed the comparison due to the state AI tooling was in. Google practically forced all its engineers to use AI tooling far before it was ready, and many of us have burned out, and many of us have very strong opinions of how garbage this technology is. But over the past year alone we’re now at the point where AI models - with some guidance - can perform many junior development tasks - like putting together a simple website or writing a hyper specific tool. Oh, and shout-out to my then-manager-now-retired-friend Patrick - whose (exclusive, I am very fancy) newsletter encouraged me to dig into how AI tooling has changed. Thanks Patrick, I’ll probably send this to you.

In fact, Gemini Pro even helped me with an outline of this article. These are still my own thoughts, typed out with my own two hands (I find angrily typing out my thoughts to be therapeutic and the best part of writing). But there’s no writer’s block - I’m not staring at a blank document anymore. In front of me is a stub of an article that I hate with a passion, and this burning hatred for the AI-authored stub is what’s pushing me to write down my thoughts in one go.

You see, for a while I used to group AI with other tech trends like big data or blockchain - impactful technologies, but not something that fundamentally rewrote the playbook on software development. Yes, our databases are now order of magnitude larger, but we’re still using the same interfaces to engage with them - and it’s now just “data”. And blockchain, outside of niche problems, turned out to be a grift. No, AI is really closer to industrial revolution. And yeah, the news sources and many folks I know have been using these words have been saying this for years - but that just sounded too grandiose to be true. I couldn’t see the forest of changing job landscape for the trees of not-quite-yet mature models. But I think it’s true: the means of production will evolve.

Anyhow, Kate’s comments prompted me to look into how others adapted when their familiar landscapes changed.

The idea that “junior engineers won’t exist, so senior engineers won’t exist” has a simplistic appeal. However, it often overlooks how industries, and the people within them, actually progress. The software engineering career pipeline isn’t necessarily breaking - it’s just getting rerouted through unfamiliar territory.

Let’s be clear: the old model, where experience was often gained through highly repetitive tasks, was never perfect. It was simply the established way, the way of our ancestors: software engineers learn some math and not-particularly-useful concepts in college (or take a coding bootcamp, which is much faster, and in my experience, produces similar results), join a company, shadow more senior engineers, write some terrible code, make a few expensive mistakes for the company to absorb, and eventually graduate into productive developers of software. But like any system with inherent inefficiencies, this progression system was always susceptible to disruption.

This kind of transformation isn’t unique to software, and isn’t unique to AI. And in my brief research I found many examples - here are the three representative example - one where the career pathways evolved, one where that path was closed, and one where it became easier.

The factories

Let’s get the factory floor comparison out of the way - it’s not great, but it sort of works.. Getting to start in manufacturing meant working on an assembly line, performing a repetitive task hundreds of times a day, being noticed by the supervisor, and eventually being promoted up the chain. Throughout the later part of the twentieth century, industrial robots became a thing - these were big, dumb robots, but they could do what a worker did more consistently, sometimes faster, but most importantly - for a constant lower cost, and without sick days or unions.

The junior roles on the factory floor have changed - it’s now all about monitoring, maintaining, and troubleshooting the machines. Many jobs shifted from the factory floor to the office - you needed your CAD operators and technicians. The pathway to becoming a manufacturing professional is no longer about enduring years of menial back breaking labor: it’s all about understanding and interacting with automated systems.

The career ladder, while different, is still there for those who were willing to make the switch.

Opportunities aren’t better or worse - they’re just different.

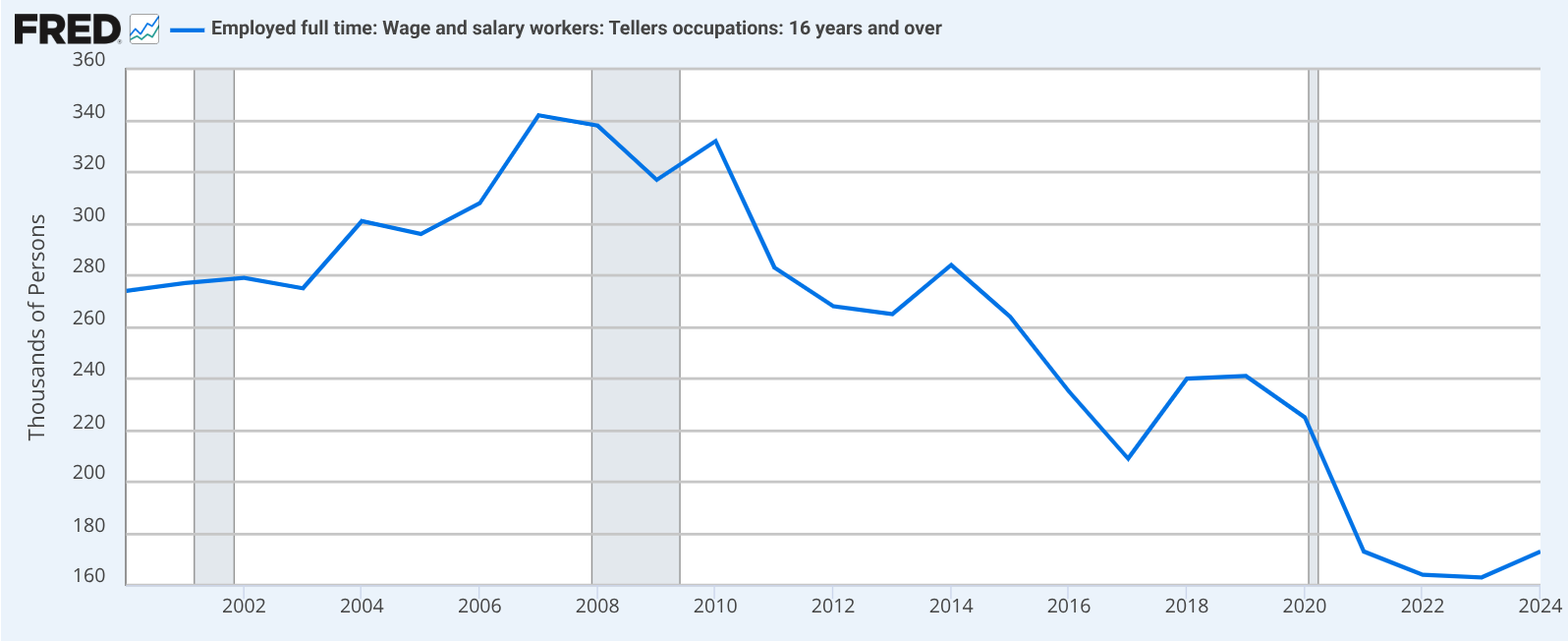

Banking

Bank tellers. For a long time bank teller was a potential entry point into the world of finance. Learn the procedures, handle cash, advance through the branch, and move onto corporate. Then the ATMs were introduced in mid-twentieth century (in a moment of vulnerability I’d like to admit that I didn’t realize that ATM stands for Automated Teller Machine). The need for accepting and dispensing cash has diminished.

The teller jobs changed. It wasn’t about counting bills (and in fact, if you’ve been to a bank recently and interacted with a teller - they don’t really count the cash for you). The job didn’t die out, but is mostly about customer service and selling products for the bank.

With a change to teller’s role - now mostly of a customer service representative and a salesperson - a direct path from teller to a finance analyst is mostly no more. A finance degree and proficiency with financial software are what’s advantageous here, with the teller counter experience becoming irrelevant.

The door closes. Actually, the door’s been bricked up altogether.

Photography

Now for something that might have actually gotten better for folks trying to break in: photography. Ask your parents (or grandparents if you’re Gen Alpha) – about becoming a pro photographer pre-digital. It was a mission: you needed a darkroom, which meant space and a boatload of chemicals that probably weren’t doing your health any favors. Equipment cost an arm and a leg, film was pricey, and developing film was a whole other cost and skill. You’d need to wait hours or days to see if those expensive shots were any good. Apprenticeships were common because the barrier to entry, both in cost and arcane knowledge, was sky-high.

Then digital cameras, especially affordable DSLRs in the 2000s and eventually decent smartphone cameras changed the industry. Suddenly there’s no more darkroom alchemy - with Photoshop your house no longer smelled like a chemistry set. The learning loop shortened from hours or days to seconds: take a picture - look at the screen - delete - take another picture, and abundant online tutorials make learning free and accessible for all. S

Even distributing your work is easier - no longer do you need to contact a publisher or beg a gallery to look at your prints. Instagram, Flickr (is that still a thing?), and other photo sharing sites allow you to reach global audience in a few clicks. Yes, the market’s flooded, and everyone and their mother are a photographer now. Experts still do stand out in the sea of amateurs, although it’s definitely much harder to do so. But the pathway to learning the craft and getting the audience has been democratized.

Knowledge is widely accessible, and entry costs are significantly lowered.

A common pattern emerges: the mundane, the highly repetitive, the work that served as “experience building” largely through sheer volume – that’s what tends to get automated. And as a software engineering manager, that’s what I usually leverage junior engineers for. And that’s not setting them up for success - oh no it’s not.

So, what does this mean for software engineering, and what can we practically do?

Think about the evolution of programming itself. We moved from wrestling with machine code and assembly to C, where we gained more expressive power but still had to meticulously manage memory. Then came languages like Python or Java, which abstracted away much of that lower-level complexity, allowing us to build applications faster and focus on different, often higher-level, business problems. Each step didn’t eliminate the need for smart engineers; it changed the nature of the problems they focused on and the tools they used.

This AI transition feels like another such leap - albeit somewhat more dramatic - and there are more tech bros, and some of the NFT drifters have joined too. Which, combined with the costs and rough edges, makes it harder for some of us to see the value behind the technology. Yet, we’re getting a new set of incredibly powerful, high-level tools. The challenge isn’t that the work disappears, but that the valuable work shifts to orchestrating these tools, designing systems that incorporate them, and solving the new classes of problems that emerge at this higher level of abstraction.

If the common understanding of a junior software engineer is someone who primarily handles boilerplate code, fixes very basic bugs, or writes simple unit tests that could be script-generated, then yes, that specific type of role is likely to disappear. That work was more about human scripting than deep engineering.

The career path isn’t vanishing; it’s demanding different skills, often earlier.

For junior developers

Frankly, the advice for junior developers hasn’t really changed. Unlike Steve Yegge, I still think you should learn Vim though.

- Learn the tools: Your early-career work will increasingly involve interacting with AI-generated code, understanding its structure, integrating it, and debugging the subtle issues that arise. Developing effective prompts, validating AI outputs thoroughly, and fine-tuning models for specific tasks will be valuable skills. This is still foundational work, but it requires a different kind of critical engagement.

- Get good at learning: Tools and AI models will evolve quickly. The ability to teach yourself new paradigms efficiently is crucial. Focus on the underlying principles of software development; they tend to have a longer shelf life than specific tools.

- Develop scepticism: Don’t implicitly trust AI outputs. Your value will increasingly stem from your ability to critically evaluate, test, and verify what machines generate. Seek to understand why a tool produced a particular result.

- Practice: Theory is essential, but practical application is where deep learning occurs. Use these new AI tools to build something non-trivial. The challenges you encounter will be your best teachers.

- Tread with caution: Your senior peers might be sceptical of AI tooling. There’s a lot of hype, and senior developers have been through many hype cycles - I know I have. Show, don’t just tell, and be prepared to defend your (AI-assisted) work rigorously.

For senior engineers and managers

These are the steps my peers and I should be taking to set up those in our zone of influence for success.

- Adapt: Your role isn’t to shield junior colleagues from AI but to guide them in using these powerful tools effectively and ethically. This requires you to understand these tools well. Mentorship will likely focus more on system-level thinking in an AI-augmented environment.

- Re-evaluate skills: Consider how AI changes the value of certain traditional skills. Is deep expertise in a task that AI can now perform rapidly still the primary measure, or is the critical skill now defining problems effectively for AI and integrating its solutions? Your metrics for talent should adapt.

- Engage with tools: To lead this transition, you need firsthand experience with these tools. Understand their capabilities, limitations, and common failure modes. This practical knowledge is essential for making informed decisions and guiding your teams.

- Redesign tasks: Phase out giving juniors only the highly repetitive tasks that AI can now handle. Instead, structure initial assignments around using AI tools for leverage, then critically evaluating, testing, and integrating the results. Their first “wins” might be in successfully wrangling an AI to produce a useful component, then hardening it.

- Teach AI skepticism: Don’t assume junior developers will know how to question AI. Make it a core part of their training. Ask them to find the flaws in AI suggestions, to explain why an AI output is good or bad, not just that it “works.”

True engineering skill has always been about problem decomposition, understanding trade-offs, systems thinking, debugging complex interactions, and delivering value (to shareholders). AI doesn’t negate these fundamentals; it changes the context in which we apply them and the leverage available.

New engineers often lack deep context and the experience of seeing systems fail. AI won’t provide that - in fact it’ll make it harder to spot a lack of fundamental understanding.

The path to seniority won’t be about avoiding AI; it will be about learning to master it, question its outputs, and work strategically with it. It will require fostering critical thinking and deep systems knowledge to use these powerful tools wisely.

The old ways of gaining experience will not disappear - they will evolve. The challenge is to define what skill looks like in this new landscape and ensure our learning pathways effectively build it.

The future will need senior engineers; they will be the junior engineers of today who navigated evolving technological terrain and learned to harness its potential. It’s time to start mapping that new path.

-

Looking back on small web communities

Staying on the theme of nostalgia, I’d like to talk about small web communities. This post is a part of IndieWeb blog carnival - an alternative form of independent, personally curated content aggregation on a specific topic. I think that’s a pretty neat idea, a throwback in itself to how I used to discover cool stuff. This month’s carnival is hosted by Chris Shaw.

The fact that “small web communities” is a nostalgic topic for me should speak volumes about how I engage with the web today – or perhaps, how I don’t in the same way. But let me start at the beginning.

My relationship with web communities kicked off in the mid-2000s. I was probably in middle school, and while I’d had a computer for a while, the internet wasn’t yet a fixture in our home. That wasn’t a huge deal; my digital world mostly revolved around video games anyway.

Then came the cell phone era. Suddenly, every kid at school had one, and my mom, bless her, got me one too – and a smartphone at that! I think it was the Sony Ericsson K750. Man, that thing felt like a marvel of technology. It played music, snapped pictures with its (then impressive) 2-megapixel camera, and – get this – it had a web browser! I could actually browse the web using (very expensive, very slow) mobile data.

It was on that tiny 176x220 pixel display that I stumbled into my first real online community. A schoolmate showed me this internet forum specifically built for phones. It was a godsend: low data requirements, images disabled by default (a blessing for my GPRS connection!), and topics covering a vast array of subjects – including, crucially, video games and tabletop gaming!

I became a frequent poster. I dived into countless threads, argued passionately about silly things (like Diablo II not really being a role-playing game - “you don’t play a role”), and even played through forum-based role-playing games. Quite frankly, I’m impressed I didn’t graduate school with carpal tunnel from all that WAP browsing (that’s Wireless Apllication Protocol if you’re not familiar). The other posters were mostly teenagers too, and over time, a small tabletop gaming community formed around that forum. There were maybe 20 of us, tops. We lived in different cities, went to different schools, but we were connected by our shared love of tabletop gaming, forum-based RPGs, and the low bandwidth afforded by our phones.

There was genuine camaraderie, a lot of laughter (typed out, of course), and the occasional burst of teenage drama (I vividly remember employing some social engineering to obtain my “rival’s” password and writing profanities on their profile page). It felt real.

Closer to the end of the 2000s, things escalated. I finally got dial-up at home. I lived in a small town, and dial-up was still pretty common there (a good reminder that I didn’t grow up in the US, so the pace of internet adoption was a bit different).

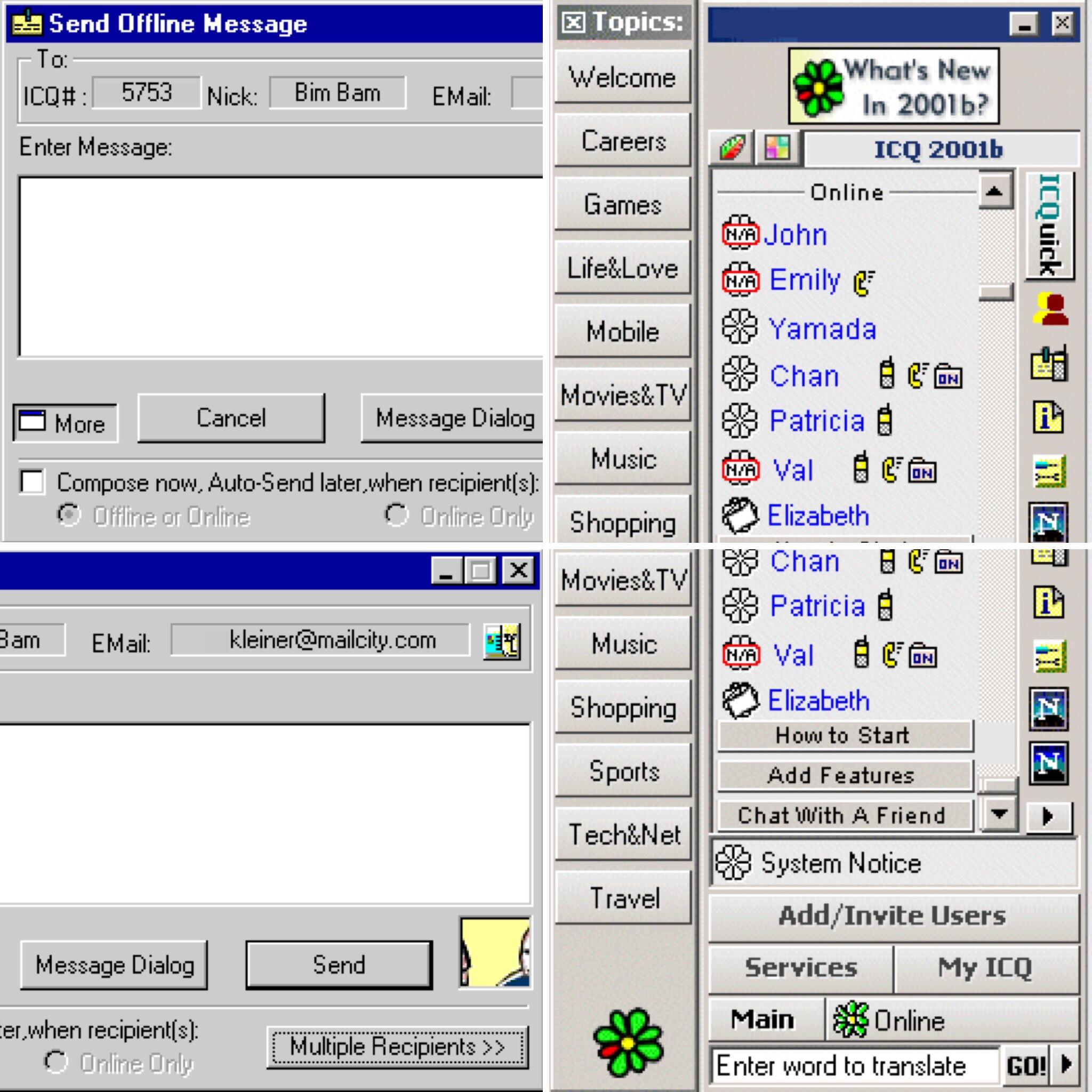

I was also neck-deep in my rebellious teenager phase – blasting heavy metal, rocking a black jacket and steel-toed boots (an outfit my ever-supportive mother actually bought for me to encourage my “rebellion”). MySpace was the place to be around that time, and I’d diligently seek out other alternative-looking teenagers from my town, add them as friends, and then the real conversations would happen over ICQ.

For those not in the know, ICQ was huge. It was kind of AOL Messenger’s cooler, more international predecessor. AOL didn’t really take off in Russia, but ICQ went on strong for ages – until being acquired by VK in 2010 and finally shutting down in 2024, ceasing its operation after a whopping 28 years. Long live the king, indeed.

As an aside, thinking about ICQ makes me a bit wistful for the era of interoperable protocols. Remember Jabber/XMPP? Google Talk ran on it, and you could use various clients to connect to different services, including ICQ gateways. There was this sense that you weren’t locked into one company’s ecosystem. You could pick your client, connect to your network, and chat with people regardless of what specific app they were using, as long as it used the same protocol. It felt like the web was more open, more… connected in a federated way. We’ve lost a lot of that. Now, everything is a walled garden, and I can’t help but feel that this shift has made it harder for those little, cross-platform communities to organically form and thrive. Everyone retreated into their own digital fortresses.

I spent countless afternoons after school, evenings, and late nights glued to that computer screen, chatting about the events of the day, school gossip, music, and, naturally, gaming - both tabletop and video games. Some of my ICQ friends were from out of town, people I’d never met in person, but they still felt like real people, tangible individuals on the other side of the screen.

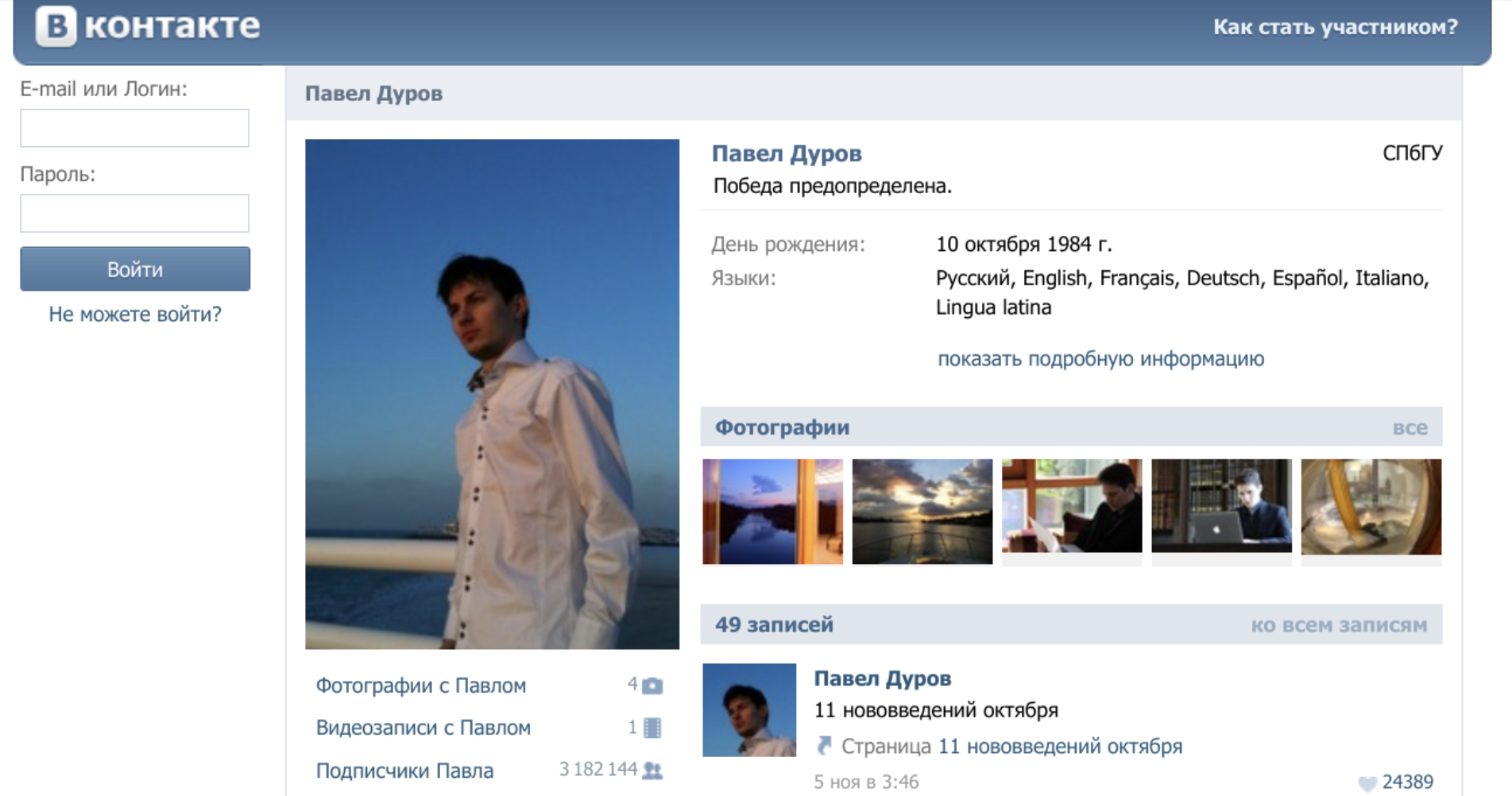

This brings me to VK (VKontakte), which really started to take off around that time in Russia, much like Facebook did elsewhere. These massive platforms were amazing in their own right – connecting everyone – but they also marked a shift. Suddenly, communication became centralized. Instead of seeking out niche forums or specific Jabber groups for your interests, you could just join a massive VK group with thousands, or even millions, of members.

It was convenient, sure. But something was lost. The intimacy of those smaller spaces started to fade. The signal-to-noise ratio went through the roof. While you could find more people, it became harder to find your people, or at least, to have the same kind of focused, tight-knit interactions. The algorithms started to decide what you saw, rather than the curated flow of a smaller, human-moderated community. It felt like the digital equivalent of a bustling, anonymous city replacing a cozy village. As I started using VK, I became connected with a lot more people, spent more time scrolling through algorithmic content, and the smaller forums I engaged in just sort of… faded out?

Despite this changing landscape, my journey into distinct online communities wasn’t completely over. Through someone I knew (no doubt from an ICQ chat), I discovered Space Station 13 – a game that really clicked with me. I dived headfirst into a close-knit Russian-speaking community for the game. I ended up becoming the custodian for the in-game wiki and eventually found myself heading up the server as a de-facto community leader. This was a noticeably larger community than my old forum haunts, with hundreds of active members, but the core crew of maybe 20-30 moderators and regulars maintained a very distinct (albeit, in retrospect, sometimes toxic) culture.

And again, the key thing was that each participant had their own personality – a distinct, real person on the other side of the screen. Some people were absolute good Samaritans, contributing to the wiki, the forum, or the server code. Others… well, others were notorious griefers who reveled in chaos. But they all felt like real people, because they were real people. Passionate, excited, sometimes infuriating, but undeniably real. There was drama around fudged moderator elections, complaints of hacking, tensions between role-players and munchkins… Yeah, real.

At some point, life happened. I moved to the US, my professional career started demanding more and more of my attention, and I gradually disengaged from the Space Station 13 community. I think this was around 2011-2013. I spent a number of years here focused on my career and professional growth, and frankly, I didn’t really engage with any specific internet communities for a while. My free digital time was mostly soaked up by solo experiences – video games and shows. Many, many hours were lost to the landscapes of Skyrim and the Cylons of Battlestar Galactica.

I did try to recapture some of that old magic. I remember joining a few local or interest-based IRC channels, hoping to find that spark. But the audience was always much, much older than I was at the time, or the vibe just wasn’t right, and I had a hard time connecting with people. I didn’t stick around for long in any of them.

Eventually, like so many others, I started using Reddit and YouTube more and more. I began relying on upvotes from massive, amorphous communities and the ever-present algorithms to introduce me to content. And for a long time, I didn’t really feel the need to engage with people as intimately online as I once had.

Real-world friendships, connections, and experiences had also, thankfully, taken center stage.

And then, relatively recently, as I was writing about my nostalgia for the old web, I discovered the IndieWeb. And something about it – its philosophy, its community, its focus on owning your own content and connecting on a more personal level – reignited that old desire to be part of a concrete, intentional online community. I’m excited about the idea of your personal website being a part of the larger network, heavily encouraging communicating with and actively hyperlinking to other sites.

I’m engaging in IndieWeb chat, I added my blog to the IndieWeb Webring, and, as of this submission, I’m participating in an IndieWeb blog carnival.

It feels like coming full circle, in a way.

-

How a shredder brought me joy

I like staying organized, one could say a little too much (or as my therapist puts it, “mild OCD”). This is going to read like an ad, but that’s because I’m just really excited about having a shredder now.

In addition to keeping the house tidy and my digital life clean, this involves keeping all relevant mail scanned, backed up, and nicely organized. Despite paperless opt-ins, banks, hospitals, and any random Joe love to send me physical mail. So I scan the letters, and if the contents are sensitive, file them with the hope that I’ll find a way to safely dispose in the future.

And then there’s junk mail. Average American household receives 848 pieces or 40-41 pounds of junk mail a year (according to widely cited but ultimately lost ForestEthics report). And that’s just junk mail. That’s 16 pieces of junk mail a week. Thankfully I’ve been able to reign that in with PaperKarma to 1-2 pieces of junk mail a week, but it still builds up. By the way, PaperKarma one-time lifetime membership is absolutely worth it - best $59.99 I ever spent. That’s not an ad, I just really like the product.

All that to say is that I’ve built up a lot of sensitive documents that need to be safely disposed of. I don’t feel comfortable just throwing those in my residential trash bin: US Supreme court ruled that dumpster diving is not a criminal activity. And while I (hopefully) don’t have the enemies required for someone to specifically target my trash cans, I just don’t feel great having my banking information or medical records being, you know, out there. I could take my documents to local UPS or FedEx location, but I wanted to do something at home. Lo and behold, a shredder:

Now, I’m not a fan of Amazon Basics business model - copy top product in a category, bump up their own products in Amazon search results, undercut competitors by low prices (often selling at a loss), and then raise the prices once the competitors are out of business. But their shredder is pretty cool, so I got one. For only $42.99 I became a proud owner of a P-4 security standard Amazon Basics shredder.

What’s a P-4, you ask me? DIN 66399 / ISO 21964 (Wikipedia) conveniently outline the following shredder security levels:

Level Use case P-1 Non-sensitive documents, e.g. forms. P-2 Internal documents, e.g. memos. P-3 Personal information (e.g. addresses). P-4 Financial and tax records. P-5 Corporate balance sheets. P-6 Patents & R&D documents. P-7 Top secret intelligence documents. With each level increase, the pieces get smaller. Anything P-3 and under doesn’t seem sufficient for sensitive documents, specifically because they allow for documents to be cut up in strips of any length. Levels P-4 and up require smaller and smaller particle size.

P-4 lands on pieces 6 mm or smaller. At this point piecing a single document back together is effectively an impossible task. P-5 (pieces less than 2 mm) is an overkill for personal data, and comes with a huge jump in price. P-4 it is.

So here I am, having the time of my life with a Amazon Basics P-4 shredder. I’m sure there are other brands that could be better, or might follow more ethical practices - but this baby’s cheap, and it’s been a workhorse of the Osipov household. It can fill its attached bin before overheating, after which the little shredder needs to take a break for about an hour. But that’s a lot of documents!

I’ve been able to shred hundreds of scanned documents I stored, and guess what - this thing can even shred old credit cards (as long as they’re the plastic kind - sorry AMEX). I get giddy when I get mail because shredding things is just never-ending fun.

Yeah, I know it’s silly, but it’s such a therapeutic experience. There’s something magical about seeing your private information destroyed in front of your eyes. If you’re a dork like me, you should get a shredder. You’ll be a happier person.

-

Our monthly family finance huddle

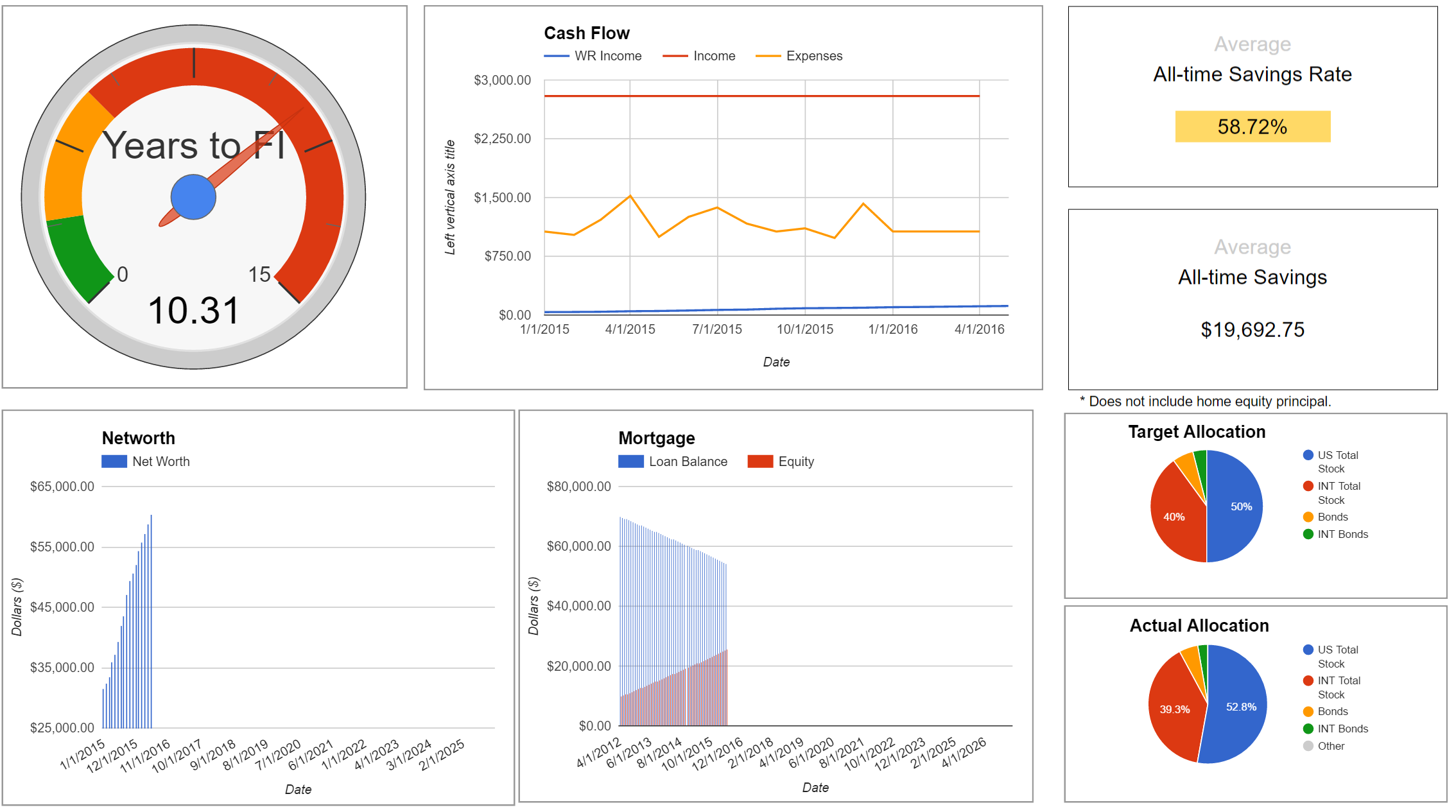

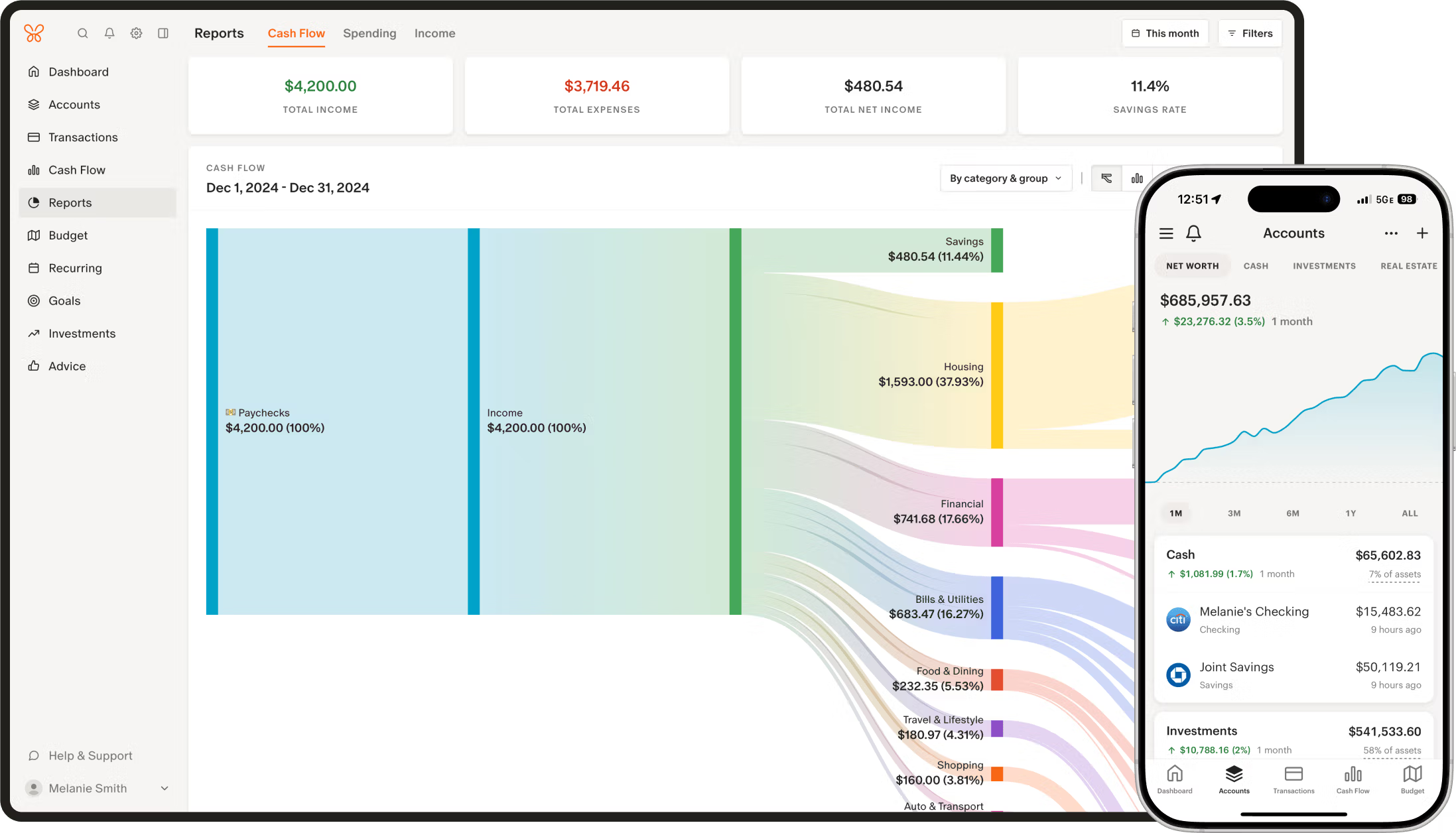

The title could be a bit misleading: I’ll be talking about how the Osipov household runs our monthly financial check-in. I’m not brave enough to share the details of our family finance on the Internet (but I’m happy to grab a coffee and chat - face-to-face I’m an open book). Because of that, this post is light on detailed screenshots and tables, opting in for generic visuals and overall vibes.

While my wife and I share the same values of frugality, not keeping up with the Joneses, and spending our money where it matters, our approach to personal finance differs. My partner thinks of money in terms of buckets - cash coming in from source X is different than cash coming in from source Y, and must be accounted for differently. It’s all about budgeting, a complicated web of accounts and buckets, as well as many automated transfers. I, on the other hand, have a much more free-for-all approach to personal finance. I don’t spend money if I don’t have to, and to me credit card points are no different than the dollars coming in from a paycheck. We’re both equally frugal, but we get there differently.

On the first of every month (plus minus a day or two - life tends to get in the way), my wife and I go through our financial check-in. It’s something we’ve done consistently for years, and I think in addition to controlling our spending, our monthly reviews have helped us be on the same page.

Since 2017 we’ve been keeping our finances in a spreadsheet. Originally built off of the IndyPendent’s one sheet to rule them all, it’s been rewritten many times over. It’s also a great opportunity to refresh the sheet during our check-ins. In fact, I’ve written about how we track portfolio allocation before - that’s one of the sheets within our larger file.

So, what does this monthly ritual involve?

First and foremost, we log the value of all of our accounts as of that day - 401k, investments, credits cards, mortgage - all of it. Having a log going back multiple years really helps. You get to see how your net worth and savings rates correspond with life and world events over time. Because of this rigorous accounting, I’m able to run fun analyses like savings rate plotted over 8 years.

While we keep the original spreadsheet the source of truth, we sometimes try out different personal finance services. We always use the spreadsheet, but sometimes we might use something else alongside it. Monarch is my current favorite: it connects to our institutions, allows you to set rules for transaction categorization, and most importantly natively supports CSV imports and exports for every page. Monarch is worth the money (at least for now), here’s a 50% off the first year.

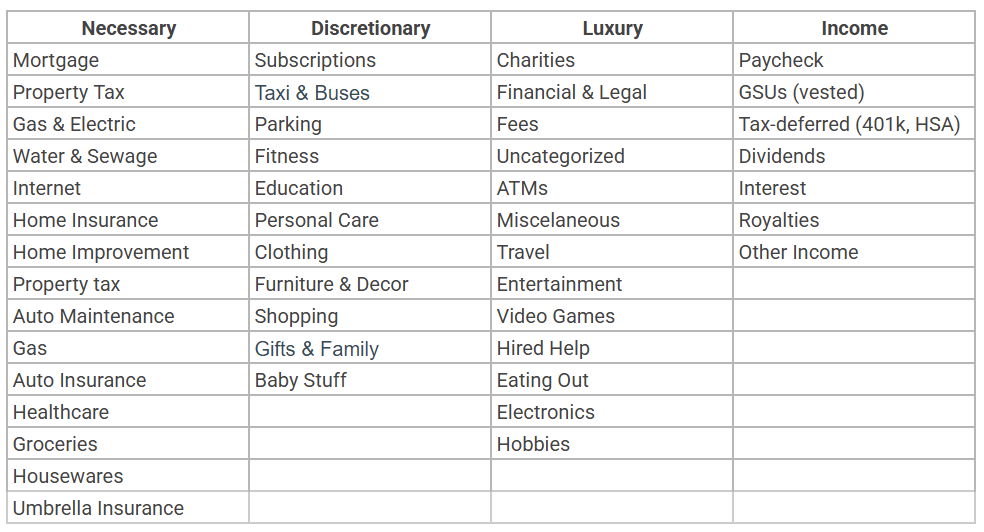

So, back to the first of every month. We use the same transaction categories in our spreadsheets and in Monarch, so we’re able to import the transactions one-to-one. And it’s great to be able to leverage robust Monarch categorization rules! This is where we track where every dollar goes.

Right, so updating spreadsheets and syncing Monarch is just the mechanics. The real meat of our monthly check-in is the conversation that follows. You might imagine that with my wife’s structured bucket system and my more, let’s say, holistic view (although my approach can be better described as “vibes”), these chats could get tense. But honestly, because we do this regularly, it’s usually pretty smooth sailing – more of a collaborative tune-up than a debate.

Here’s a taste of what actually goes down:

- Expenses recap: We eyeball the spending categories. “Okay, looks like dining out crept up a bit last month – maybe we dial that back?” or “Nice, we really kept the grocery bill down.” Sometimes it’s just acknowledging reality, like the inevitable sigh when we see the combined total for Amazon or Trader Joe’s. Seeing the numbers laid out often sparks easy agreements on minor adjustments.

- Looking ahead: This is crucial. “Hey, tax season’s coming up, do we have enough saved up?” or “We talked about that weekend getaway, should we start putting money aside specifically for it?” It prevents big expenses from sneaking up on us and lets us plan. My wife might earmark funds in our budget; I might just mentally note, “Okay, less random spending for a bit.”

- The big picture: How are we tracking towards the big stuff? Retirement contributions, mortgage paydown, saving for [insert next big goal here]? Even if the market’s doing crazy things (cue the “oh God where are the stock markets” comment), we look at our savings rate and long-term progress. It grounds the month-to-month fluctuations.

- Mixed methods: This is where our different approaches intersect. My wife might point out, “The ‘home maintenance’ bucket is looking low, and we know the fence needs fixing.” I might counter with, “Yeah, but overall savings look strong this month, maybe we can cash flow it?” Often, the solution is a blend – maybe we allocate a bit more to that bucket and agree to watch discretionary spending elsewhere. The shared goal (fixing the fence without derailing savings) matters more than how the money is mentally accounted for.

- Actions: The chat isn’t just talk. It often ends with concrete next steps. “Okay, I’ll transfer $X from checking to the investment account,” or “Let’s agree to cap ‘hobby spending’ at $Y next month,” or “You research refinancing options, I’ll look into estimates for that car repair.”

It’s not always a deep, soul-searching conversation with printed out visuals and a presentation to boot (that’s what a year-end review is for, anyway). Sometimes it’s quick: update the numbers, glance at the summaries, confirm things look okay, high-five, done. But having that dedicated time every month means we’re consistently aligned. It prevents financial decisions from becoming unilateral or sources of friction, instead turning them into regular, shared checkpoints, even with our different money brains.

Typically this would be the part where I share the spreadsheet template with you (or even pretty screenshots), but the spreadsheet is currently way too customized for our individual needs, and untangling it for more general use would be quite an undertaking. But let me know if there are any aspects that interest you and I can pull out the logic similar to what I did with our portfolio allocation tracker.

-

Nostalgia for the old Web

I grew up on the Internet throughout the 2000s. I went to school, played Dungeons and Dragons and some collectible card games, and logged onto the forums after school. Me and a couple of my classmates were all on the same forums - and of course you’d learn about forums from your friends.

I didn’t speak English back then, and it was Russian speaking forums for me all the way. I’m not sure about now, but back then Runet (yup, that’s Russian Internet) infrastructure was lagging behind the English speaking world - dial-up was more prevalent, which informed the type of content that was popular. So my experience in the 2000s is probably reminiscent of someone’s experience in US in the 90s. Either way, it was the time only the nerdy kids were online.

This internet was a very different landscape from the Internet of today, with giant spaces like Facebook or Reddit. Back then, the communities were smaller, more tight-knit, and you’d know frequent posters. You’d know what troubles them, you’d know what their interests are - those were real people (or other kids, I guess), and you could really feel their existence on the other side of the screen.

There was something else there too. The Internet felt smaller, more intimate. The quality of discourse was better. You’d have these long forum threads going back and forth. Engagement on the Internet felt like a passion project, less commercialized. Webmasters proudly built bright (and sometimes jarring) websites. You proudly demonstrated your expert knowledge of emoji to express yourself. 🤓 It was a different time. It was a time before influencers, and passion was first and foremost. Building internet following wasn’t really a ticket to real-world fame and profit, and it felt more… pure?

In the late 2000s and early 2010s, I experienced this directly when I ran the Russian speaking server of Space Station 13 - a multiplayer spaceship crewmate simulation game (MandaloreGaming does a great job explaining what this game is, go watch it). Here’s the website I built:

I don’t want to toot my own horn too much, but doesn’t this just have more character? Facebook and other sites were already becoming popular around that time, but it was amazing having our own corner of the Internet. We had forums, a chat, a wiki… Now that I reflect, the community could get somewhat toxic, but it was a community nonetheless.

Of course, I feel so nostalgic about the time period in my life. I was a kid, I didn’t have to worry about paying taxes. I naturally maintained friendships because I went to school every weekday. I could obsess over the craziest things. But separate from that general nostalgia, the internet itself truly felt different.

There are still some online communities that have refused the change. From small niche interest forums, to an old-time giants like The Something Awful Forums. And of course IRC is still alive and kicking. I pop in and out of IRC chats every couple of years when I miss simple no-bloat chat spaces with fellow tech enthusiasts. Did you know that besides tech enthusiasts, IRC is widely used by site reliability engineers, at least at Google? Can’t be relying on bloated chat apps during an outage - and nothing beats IRC!

It’s even more interesting to see communities who try to recapture the olden days. There are folks engaging today, trying to follow the old ways. Projects like Melonland aim to capture the feeling of the old web. The fun part is that, at least from some discourse, this movement seems to be popular among the younger generation - folks who didn’t live through the early days of the Internet. It’s part of a small but growing online movement around late Gen Z and early Gen Alpha’s striving for digital minimalism.

For me it’s largely about the nostalgia and simplicity. A different time, but also the Internet that put self expression first and foremost, before monetization underlining every word. It’s a time where you had to seek out content to engage with, and not the other way around (looking at you, algorithmic feeds).